When retail giant Amazon stepped out of the Google Shopping auction in late July 2025, it was a huge moment that had the whole industry talking. The immediate question on every marketer’s lips was: “What happens to my Cost Per Click (CPC) now?”

The easy answer is to look at a ‘before and after’ snapshot. But easy answers are often wrong. To get to the truth, we used a Causal Impact analysis to scientifically measure the real-world effect of Amazon’s exit on CPCs across key retail verticals. The results were not what you might expect.

This report will take you through our study, explaining why we chose Causal Impact analysis, the results for each vertical, why it’s important to understand consumer intent, the actual CPC shifts we saw and ultimately why Amazon could afford to walk away from Google Shopping.

Note that as of 25th August Amazon are back in Google shopping auctions showing this was indeed a true holdout test to measure incremental value Google Shopping is providing to the revenue uplifts for Amazon.

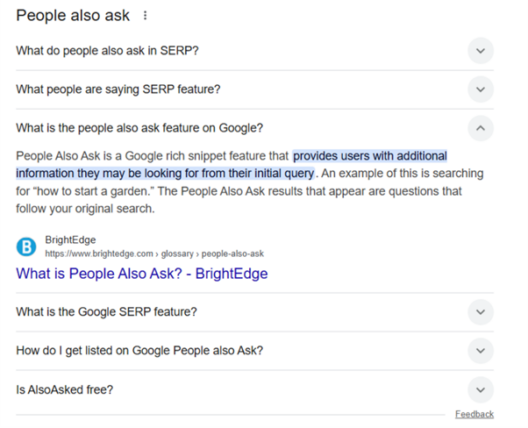

Why Casual Impact beats simple Period-on-Period comparisons

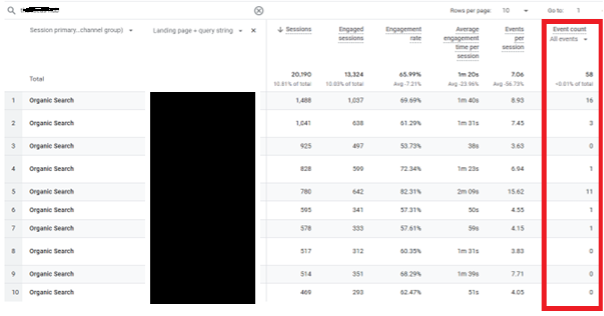

A Period-on-Period (PoP) comparison only looks at how metrics move between two timeframes (e.g., before vs. after Amazon’s exit). While useful, it assumes that any change is directly caused by the event, ignoring seasonality, broader market shifts, or randomness.

Causal Impact, on the other hand, uses a Bayesian structural time-series model to estimate what would have happened if the event (Amazon’s exit) hadn’t occurred. This gives:

- A True Baseline: It doesn’t just compare ‘before’ to ‘after’. It compares the ‘after’ to what should have been, creating a synthetic control group.

- Statistical Proof: It tells us the probability that the change was a direct result of the event, separating genuine impact from statistical noise.

A Clear Narrative: It quantifies the average and cumulative effect over time, showing whether the impact was a short-term blip or a long-term shift.

For example, a simple PoP comparison showed CPCs in the Gifts category fell by 3.3%. A tempting conclusion would be that Amazon’s exit reduced competition. However, our Causal Impact analysis revealed the confidence interval overlapped with zero, proving the effect was not statistically significant. We avoided a misleading conclusion that a lesser analysis would have produced.

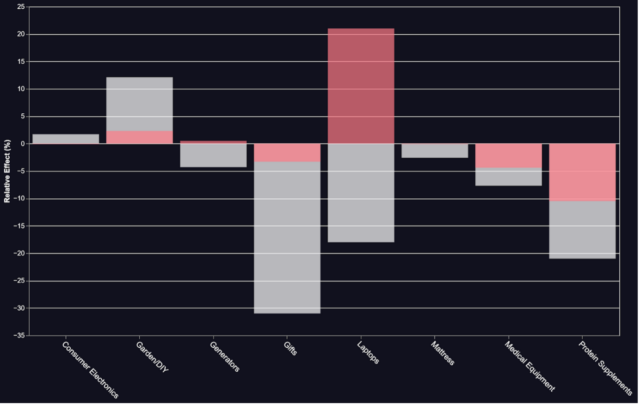

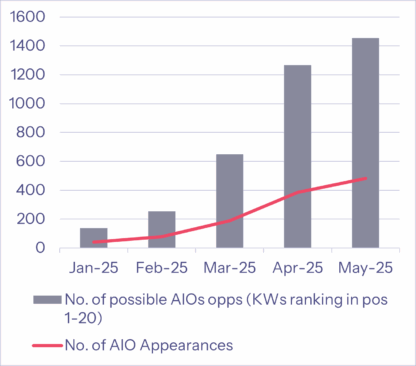

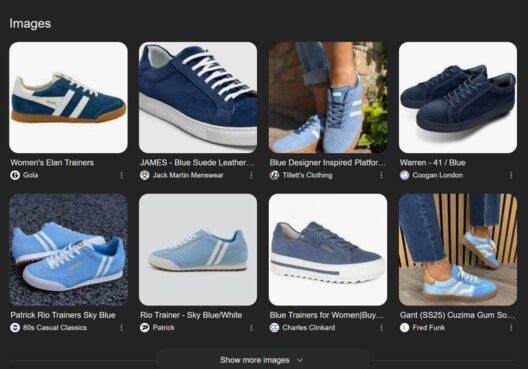

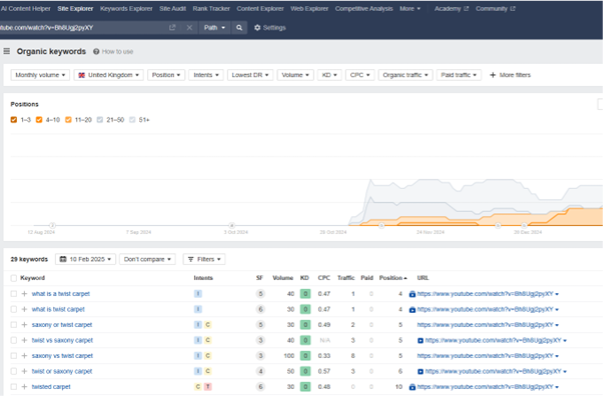

Pink is Causal Impact and Grey is PoP.

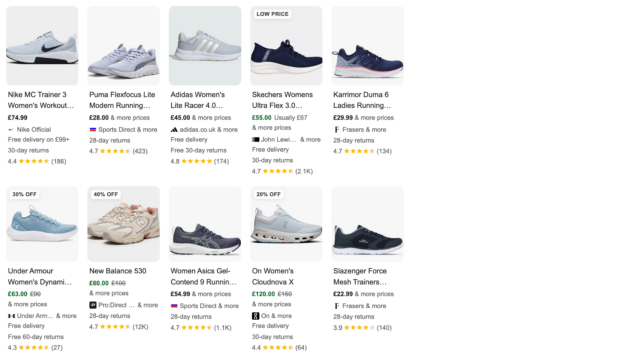

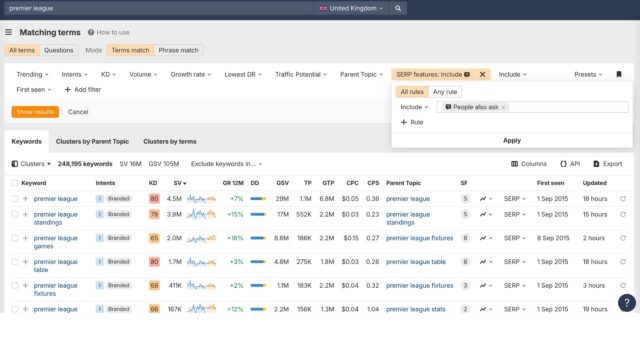

The surprising results: Deconstructing the CPC shifts

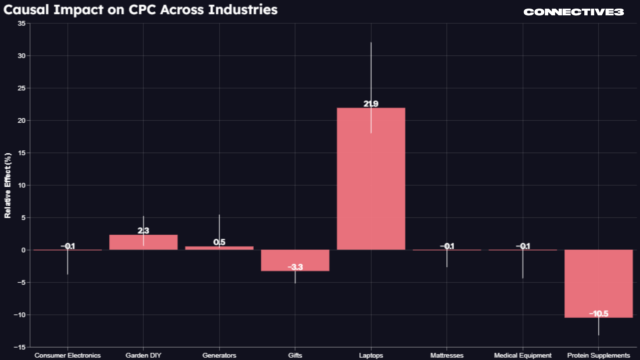

So, what actually happened when Amazon left the auction? The big surprise is that the impact was highly concentrated. We didn’t see a widespread surge in CPCs. Instead, we saw one clear winner, one category with a significant drop, and a whole lot of stability elsewhere.

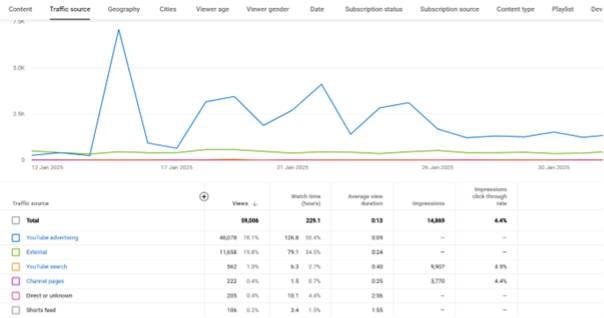

The chart below shows the statistically significant impact, or lack thereof across key industries.

📈 The major outlier: Laptops (+21.9%)

The only category to see a statistically significant and substantial CPC increase was Laptops. The story here is a perfect storm of timing and technology. Amazon’s exit coincided with the back-to-school season, a peak demand window for everything from headphones and tablets to monitors and speakers.

As students and parents began their shopping, conversion intent surged. Google’s Smart Bidding algorithms, which are designed to maximise outcomes, recognised this high probability of conversion and bid aggressively to capture those valuable clicks, pushing CPCs up. This proves a critical point: modern auctions are driven by conversion probability, not just competitor volume.

📉 The big decline: Protein Supplements (-10.5%)

At the other end of the spectrum, Protein Supplements saw the only statistically significant decrease in CPCs. This reflects a different, but equally important function of Smart Bidding: efficiency. This period often coincides with a post-payday lull in spending for this category. The algorithm likely identified lower conversion intent and reallocated budget away from less valuable clicks, causing the average CPC to drop as it optimised for efficiency.

Everything in between: Statistical stability

For every other category we analysed – including Consumer Electronics, Mattresses, Garden & DIY, and Gifts, the impact was not statistically significant. As you can see on the chart, the error bars for these verticals all cross the 0% line. Any minor CPC fluctuations observed were simply statistical noise, not a direct result of Amazon’s departure. This is a crucial distinction that only a Causal Impact analysis can provide.

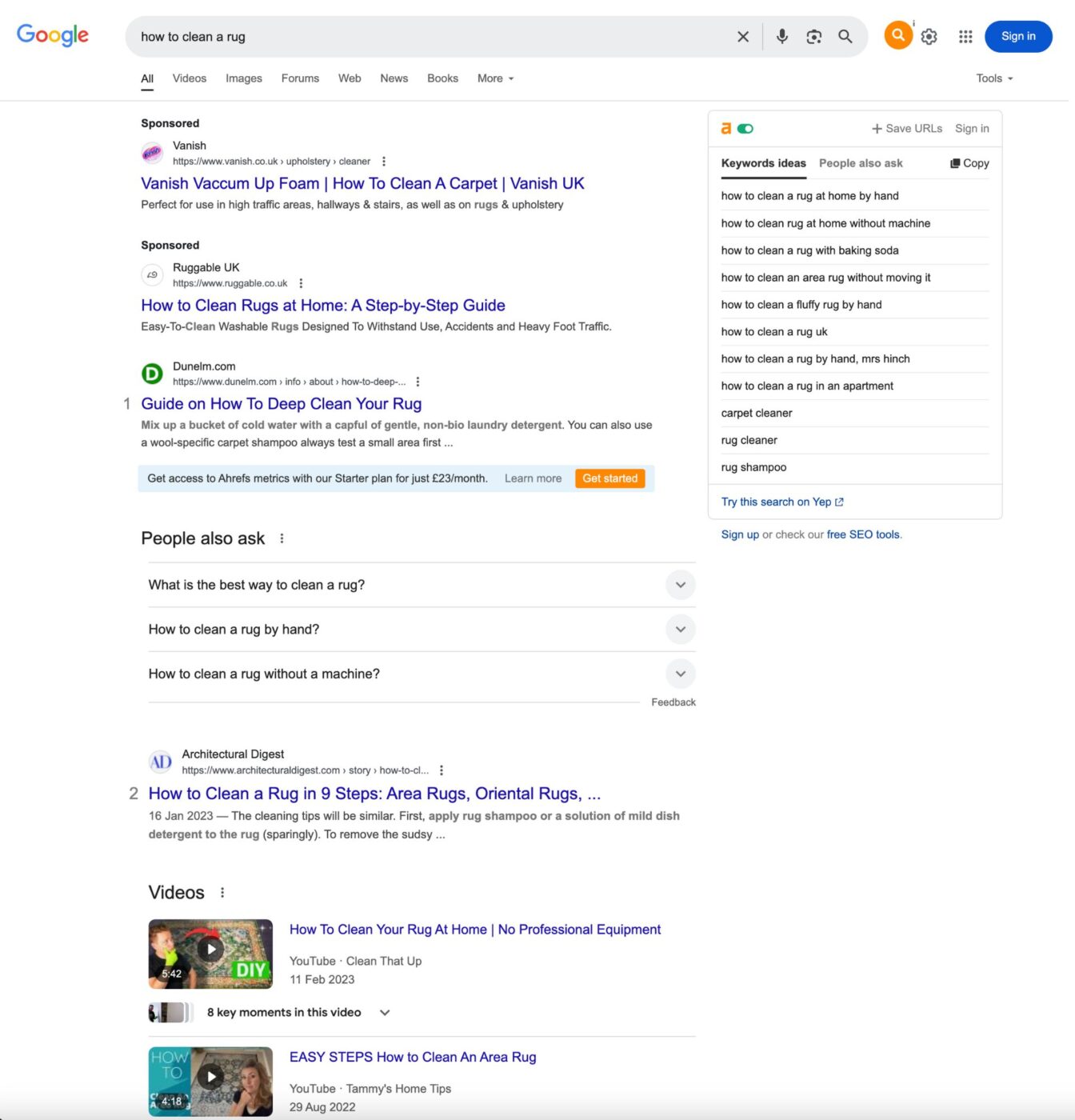

Beyond the bid: Why consumer intent trumped competition

The impact of Amazon’s absence is less about auction mechanics and more about the consumer’s path to purchase. For many products, shoppers simply don’t default to Amazon, which fundamentally changes how the market reacts.

- High-consideration purchases: When buying a mattress or medical equipment, trust, specialist advice, and brand reputation are paramount. Consumers gravitate toward dedicated retailers, meaning Amazon’s presence or absence in a SERP is a minor factor.

- Emotion-driven buys: Products like personalised gifts or unique home décor are discovery-led. Shoppers are actively browsing independent stores and specialist sites. Amazon leaving the auction doesn’t create a vacuum; it just redistributes attention among existing players.

- Commoditised products: Laptops are a different beast. Consumers are highly price-sensitive and often use Amazon as a default for convenience and comparison. When the default option disappears from the most visible ad space, it dramatically reshapes demand dynamics and forces algorithms to react.

The new rulebook: CPC is a symptom, not a sickness

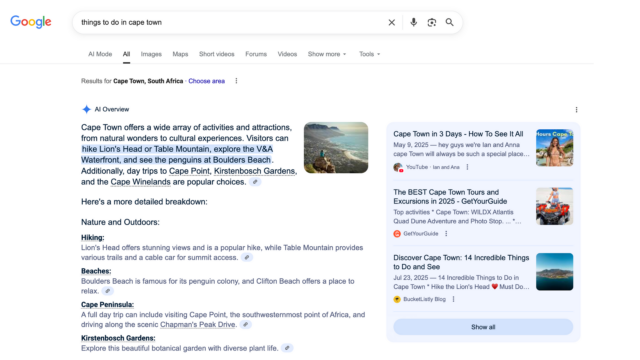

If you’re still managing your paid search accounts with CPC as your primary KPI, you’re looking in the rearview mirror. With the dominance of Smart Bidding strategies like Target ROAS and Max Conversions, CPC has become a byproduct, not a goal.

Here’s why:

- Bidding is outcome-driven: The algorithms aren’t trying to find the cheapest click; they’re trying to find the most profitable conversion.

- Auction-time signals are king: Google adjusts bids in real-time based on hundreds of signals like device, location, and audience data. It cares more about the predicted value of a user than the number of advertisers in the auction.

- Value beats volume: If the algorithm predicts a user is highly likely to convert, it will gladly pay a higher CPC to win that click, even if overall competition has decreased.

This explains our findings perfectly. CPCs for Laptops rose because Smart Bidding chased high-value, back-to-school conversions. CPCs for Protein Supplements fell because algorithms likely reallocated budget away from lower-intent clicks that are more common as consumers move away from a payday spending spike.

In today’s landscape, CPC is no longer the metric to optimise for. The true measure of success is efficiency, tracked through metrics like ROAS and cost per acquisition.

Amazon’s endgame: Why they could afford to walk away

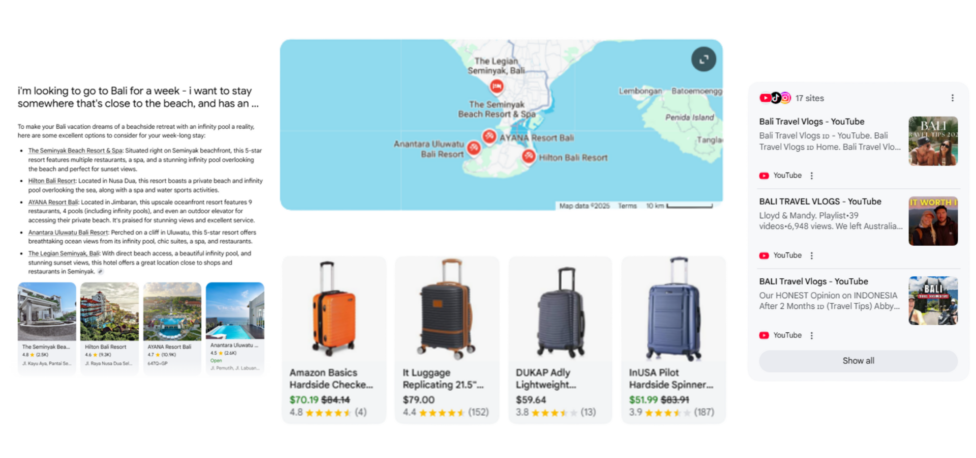

Finally, let’s consider Amazon’s perspective. For them, leaving Google Shopping isn’t the risk it would be for a smaller retailer. Why? Because consumer behaviour is already hardwired in their favour.

Studies consistently show that the majority of product searches begin on Amazon, not Google. This means Amazon isn’t just a player in the market; for many, it is the market. By pulling out of Google Shopping, they weren’t risking invisibility. They were running a massive-scale experiment to answer a simple question: “Does paying for Google Shopping ads provide incremental value, or would these customers have found their way to us anyway?”

As mentioned, as of 25th August they are back in Google shopping auctions, showing this was indeed a true holdout test to measure incremental value Google Shopping is providing to the revenue uplifts for Amazon.

Their brand gravity and established customer habits mean they can capture demand with or without being in every auction. For them, it is a calculated test of channel value, and for the rest of us, it was a masterclass in the new dynamics of paid search.

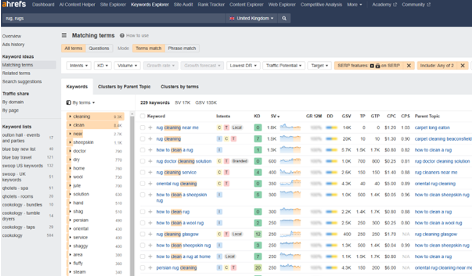

Methodology for Casual Impact Analysis

- Data Sources and Selection

This analysis utilised a combination of proprietary in-platform data from Google Ads and publicly available data from Google Trends to construct and validate the Causal Impact model.

- Treatment Data (Google Ads): The primary data source for the dependent variable was Google Ads. The specific metric analysed (e.g., conversions, clicks, branded search volume) was extracted using account-level data for the period spanning three months prior to the intervention (pre-period) and one month after the intervention (post-period). This dataset represents the “treatment” or affected data, which is the subject of the analysis.

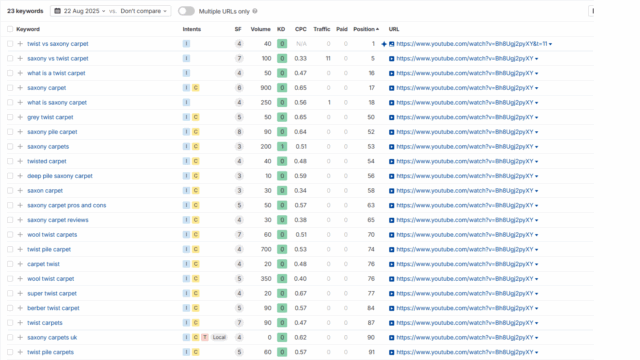

- Control Data (Google Trends): The control data, representing the unaffected “counterfactual,” was sourced from Google Trends. The selection process for the control group was critical to the integrity of the analysis and followed these steps:

- Identification of Unaffected Keywords: Potential control keywords were identified as those with search interest that was highly correlated with the treatment metric before the intervention. These keywords were deliberately chosen to be outside the scope of the campaign being measured. For example, if the campaign was for “Luxebrew Coffee Maker” an unaffected control group might be the search volume for a similar but distinct query like “Premium Coffee Blenders”

- Correlation Validation: A correlation analysis was performed on the pre-period data to confirm a strong, statistically significant correlation between the treatment and control metrics. This step ensured the control data was a reliable predictor of the treatment metric’s behaviour in the absence of amazon in auction.