Conclusion

Pre-loved purchasing is almost certainly a trend that’s here to stay. According to research from GlobalData, the second-hand clothing resale market in the UK grew by 149% between 2016 and 2022, and it was further forecast to grow by 67.5% from 2022 to 2026.13

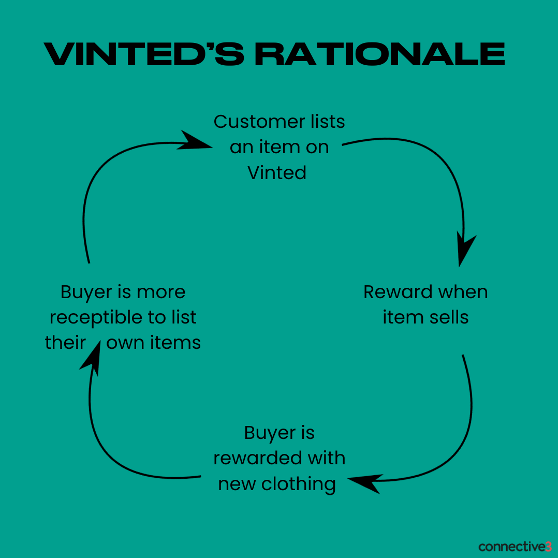

But what can brands learn from some of the major players in the space? The two brands share a similar ethos – appreciating fashion, helping customers to make some extra cash, and shop sustainably. But the ways in which they’ve focused their efforts have been different.

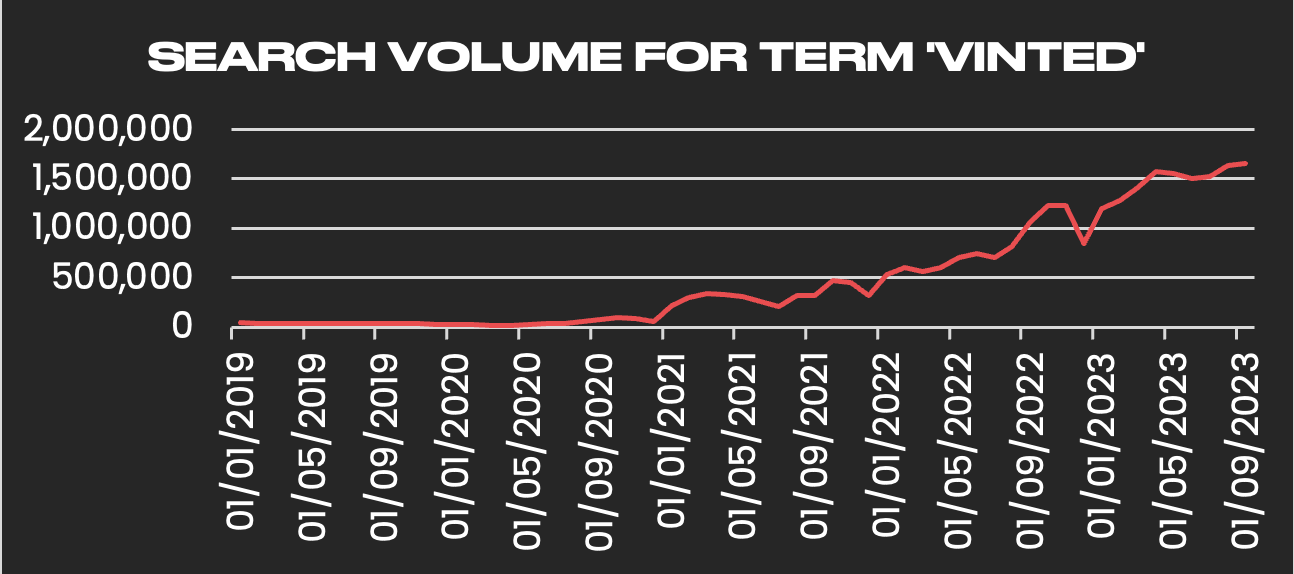

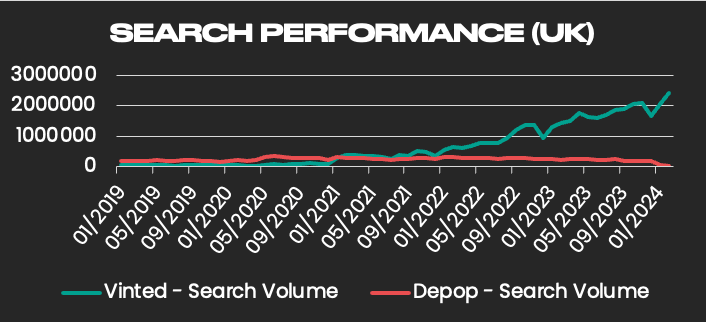

While Depop’s original appeal to Gen-Z shoppers largely came from their agile and trend-led social strategy, from a search point of view, Vinted has held stronger positions on key SERPs for longer. This may have helped increase their brand awareness amongst more casual second-hand sellers, rather than largely targeting a highly-engaged but more niche audience like Depop.

However, Depop’s recent SEO improvements seem to have paid off, increasing their discoverability – and with a stronger brand presence, they’re not to be discounted just yet.

The key learning for any brand looking to play in the second-hand or preloved space? Don’t focus on a single niche at the risk of your overall brand awareness – but don’t completely abandon that core audience, either.

Making sure that you have a varied audience across different demographics and behaviours will set your brand up for long-term success, but appealing to your core will help you to build a community that stays loyal and becomes brand ambassadors.

If you’re looking for a partner who can deliver growth and take your brand from a challenger to a market leader, then get in touch. connective3’s brand strategies combine the best specialists from multiple disciplines for best-in-class performance and unrivalled growth.